Expense Invoices

Expense invoices is an entry facility designed to allow the recording of invoices and expense claims that span across different jobs. The concept is that your employees that claim expenses either via a manually prepared expense claim or through a credit card are setup in the system as Vendors (accounts). Entries can then either be made manually or imported. In the case of Credit Card statements there may be some manipulation required in order to transform what are usually PDF statements into a table on an excel spreadsheet.

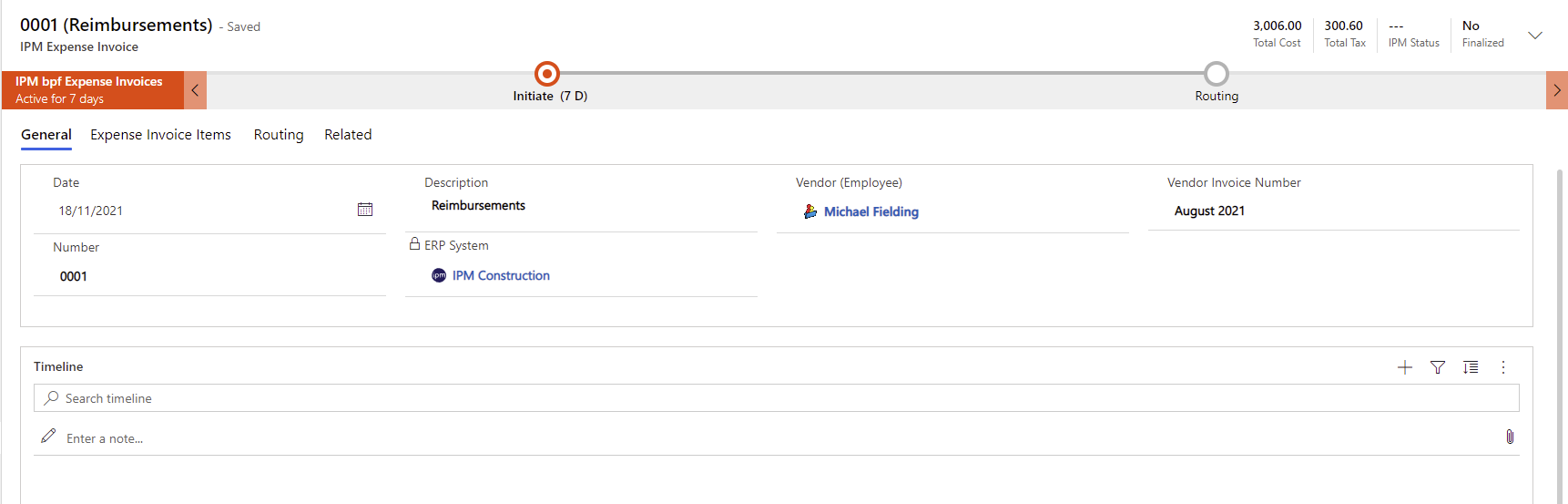

Expense Claim Creation

To create an expense claim, navigate to Contract Control and then Expense Invoices and then click the + New button on the menu ribbon.

Expense Invoices will usually be controlled by a business process so that they can be recorded by one operator but may need approval by another, in which case routing will be required. This routing will be built into the Business Process at the top of the invoice.

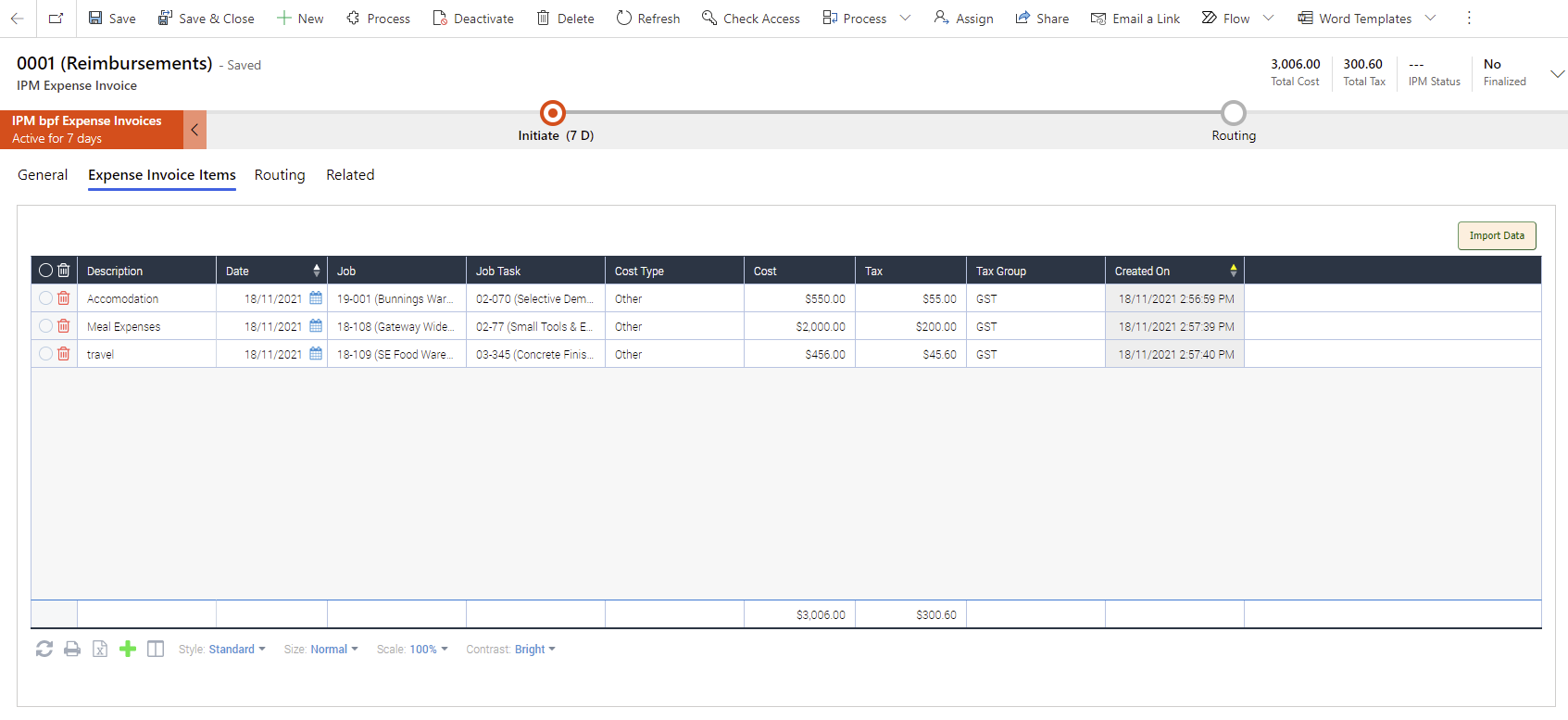

Expense Invoice Details

Expense Invoice Details can be recorded manually or imported. They can span across many jobs but must be distributed across cost codes / Job Tasks and Cost Types if your organisation uses cost types.

If your IPM deployment is integrated to a back end accounting system such as MYOB, Sage CRE or Microsoft BC then after they have been approved, they will be sent to the accounting system for payment. If you are integrated with a system not mentioned here then please check with your support organisation to confirm the integration has been developed.